Fraud

Report a fraud

You can raise your concerns or suspicions in confidence about fraud, corruption or other irregularities which are costing us and the taxpayer money by completing the online form at the link below.

St Albans Anti-Fraud Team

Fraud costs local tax payers millions of pounds each year. This prevents public money from going to the places that need it most and improving your community.

According to the latest government figures, fraud is increasing. We need your help to tackle this. If you suspect someone is committing a fraud or other illegal act against us, it is important that you let us know about it.

You can use the online form at the top of this page, phone us on 01727 819332 or email fraud@stalbans.gov.uk.

You can also write to us, marking the envelope "Private and Confidential" to:

The Head of Internal Audit, St Albans District Council,

Civic Offices, St. Peter's Street,

St. Albans AL1 3JE

Please note that all benefit fraud like Housing Benefit, Income Support, Disability Benefit, Universal Credit should be reported to the Department for Work and Pensions.

To report Adult Social Care, Blue Badge or School Admission Fraud, please visit SAFS.

Types of fraud include:

Council Tax fraud Toggle accordion

Nationally this costs £60m a year and includes:

- Falsely claiming to be living alone, or to be a student

- Falsely claiming discounts of exemptions

- Failing to tell us of income changes

Business Rates fraud Toggle accordion

According to The Chartered Institute of Public Finance and Accountancy’s latest counter fraud tracker, business rates fraud costs local authorities an estimated £7.7m a year. This includes:

- When a business tries to gain a relief or an exemption, they are not entitled to for example small business rate relief

- Deliberately not flagging when a property is empty

- Falsifying documents to show the landlord as liable for the business rates

Housing fraud Toggle accordion

Please report Housing fraud to the Shared Anti-Fraud Service (SAFS).

Nationally this costs £1.8m a year and deprives people in genuine need of a home. It includes:

- Sub letting a Council House

- Leaving a Council House empty

- Making a fraudulent right to buy application

- Providing false information to get a Council House

Procurement and contract fraud Toggle accordion

This costs Councils millions of pounds a year and includes:

- Bribery and Corruption

- Suppliers not fulfilling a contract

- Bid-rigging and cartels

Other frauds Toggle accordion

There are other frauds such as blue badge fraud, payroll fraud, and grant fraud

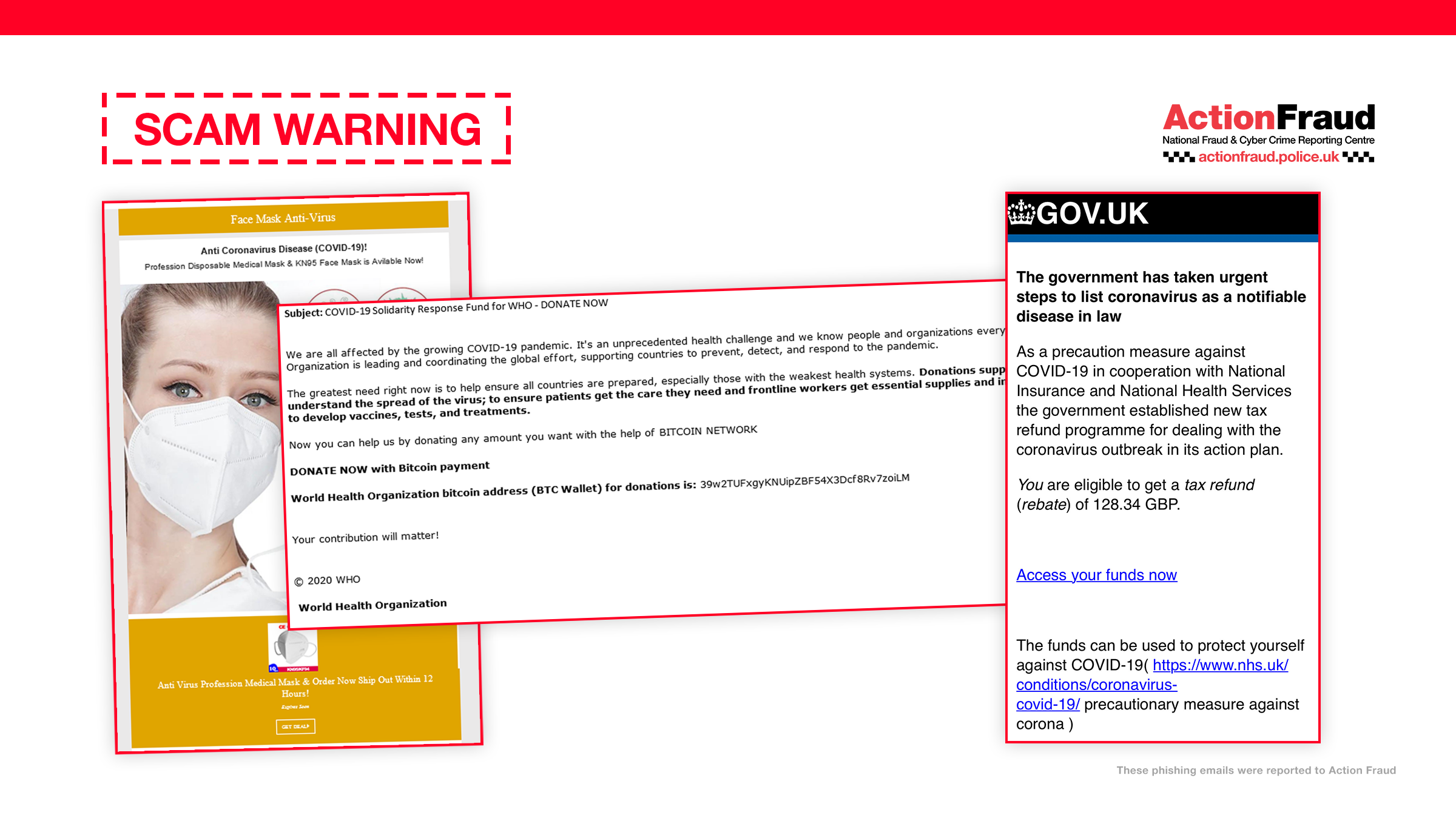

Protect Yourself from Fraud

National fraud initiative

We are required by law to protect the public funds we administer. We may share information provided to us with other bodies responsible for auditing or administering public funds, in order to prevent and detect fraud.

In October 2024, as part of the National Fraud Initiative, we will send a number of data sets to the Cabinet Office to match data and detect possible fraud across a wide range of public bodies.

What is the role of the Cabinet Office? Toggle accordion

The Cabinet Office appoints the auditor to audit our accounts. It is also responsible for carrying out data matching exercises.

What is data matching? Toggle accordion

Data matching involves comparing computer records held by one body against other computer records held by the same or another body to see how far they match. This is usually personal information.

Computerised data matching allows potentially fraudulent claims and payments to be identified. Where a match is found it indicates that there is an inconsistency which requires further investigation.

No assumption can be made as to whether there is fraud, error or other explanation until an investigation is carried out.

Why do we give data to the Cabinet Office? Toggle accordion

The Cabinet Office currently requires us to participate in a data matching exercise to assist in the prevention and detection of fraud.

We are required to provide particular sets of data for matching for each exercise, and these are set out on the Gov.uk website.

The use of data by the Cabinet Office in a data matching exercise is carried out with statutory authority under its powers in Part 6 of the Local Audit and Accountability Act 2014. Previous exercises were carried out by the Audit Commission under Part 2A of the Audit Commission Act 1998.

It does not require the consent of the individuals concerned under the Data Protection Act 2018/General Data Protection Regulation (GDPR).

Data matching by the Cabinet Office is subject to a code of practice.

More information Toggle accordion

For further details on the National Fraud Initiative, please visit the Gov.uk website.

For more information on data matching at the council, please contact:

Sally-Anne Pearcey, Senior Internal Auditor

Telephone: 01727 819336

For more information about our general data protection regulations visit our GPDR page.